Wastewater treatment

Rising Demand for Crude Palm Oil Drives Uptake of Water and Wastewater Treatment Solutions in Southeast Asia

Mar 07 2013

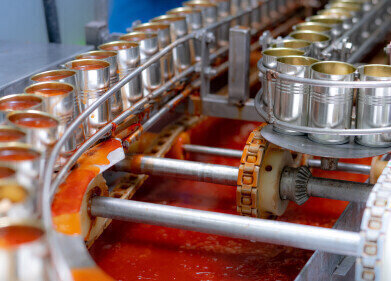

The rising application of crude palm oil (CPO) across diverse industries and the swelling global appetite for oils and fats, processed foods, cosmetics, and bio-diesel is encouraging the setting up of palm oil mills and refineries in Southeast Asia. This, in turn, is creating a lucrative market for water and wastewater treatment (W&WWT) solutions in the region.

New analysis from Frost & Sullivan (UK), Water and Wastewater Treatment Solutions Market in Palm Oil Industry in Southeast Asia, finds that market earned revenues of US$106.3 million in 2012 and estimates this to reach US$145.0 million by 2016.

Palm oil production in Malaysia and Indonesia alone account for over 80 percent of the global CPO output. Owing to this high production of CPO, the W&WWT solutions market in Southeast Asia will thrive, unlike its slowdown-affected counterparts in Europe and North America.

The intense activity in refineries, along with the strict environmental regulations that hold industry participants accountable for their effluent discharge, will drive the adoption of sludge management solutions.

The palm oil industry critically needs to treat palm oil mill effluent (POME), a key by-product of CPO production. Therefore, market participants will do well to provide solutions that reduce biochemical oxygen demand (BOD) and chemical oxygen demand (COD) from POME. They can achieve this by using membrane bioreactor as a secondary wastewater treatment.

“While most smaller mills still resort to the conventional open ponding method for reducing BOD and COD, membrane technologies remain the more costly yet most effective alternative POME treatment solutions for the palm oil industry,” said Frost & Sullivan Environmental Senior Consultant David Lee.

The high investment costs associated with W&WWT solutions will continue to peg back the market to some extent, as small-to-medium scale palm oil mills will choose to do the bare minimum to comply with the local regulations.

Nevertheless, the palm oil industry, like other industries, is gradually replacing its conventional W&WWT solutions with advanced membrane filtration system such as micro-filtration (MR), ultra-filtration (UF) and reverse osmosis (RO). W&WWT companies have to market their solutions’ ability to shrink clients’ carbon footprint, as it is a substantial benefit.

“Given that the oil palm industry is a highly price-sensitive market, W&WWT solution companies can gain an edge through competitive pricing,” noted Lee. “Besides pricing, a strong local presence and after-sales service will go a long way in ensuring success in the market.”

Events

Feb 16 2025 Kampala, Uganda

Feb 26 2025 Chennai, India

Feb 26 2025 Tulsa, OK, USA

WATERTECH CHINA (GUANGDONG) 2025

Mar 05 2025 Guangdong, China

Mar 11 2025 Amsterdam, Netherlands