Water/Wastewater

Advanced Filtration Offers Emerging Markets a Cost-effective Alternative to Water Recycling

Sep 13 2013

Stringent water and wastewater regulations, expanding population, and receding water tables have made a strong case for water and wastewater filtration systems all over the world. Emerging economies such as China, India, Indonesia, and the GCC (Cooperation Council for the Arab States of the Gulf) countries are especially fertile markets for filtration systems due to their rapid pace of industrialisation.

New analysis from Frost & Sullivan (UK), Global Water and Wastewater Filtration Systems Market, finds that the market earned revenues of $6.11 billion in 2012 and estimates this to reach $9.18 billion in 2019. It covers the segments of single and dual filter media (sand, gravel, and activated carbon), multimedia filter (sand, garnet, anthracite, and magnetite), cartridge filter media, and others (cloth, ceramic, stainless steel, novel).

The single and dual media filters segment will continue to dominate the market with a compound annual growth rate (CAGR) of 6.1 percent, due to the escalating and ever prevailing requirement for potable water. The multimedia filters segment will remain stable at a CAGR of 6.3 percent, as it is the filtration solution of choice in wastewater treatment. The expanding practice of wastewater treatment, especially across the developing nations in Asia-Pacific, will also considerably bolster this segment.

Cartridge media will experience sustained demand with a CAGR of 5.5 percent due to the high demand for process water in industrial applications. However, the high frequency of cartridge replacement will muzzle its growth to some extent. Media filtration has the largest installed base globally and will continue its strong growth.

Among regions, Asia shows abundant potential due to the evolving wastewater treatment practices and unmet drinking water needs in India and China. On the other hand, the European market appears to be sluggish because of the recent economic slowdown.

Apart from adverse market conditions, the lax supervision and enforcement of the regulations have hindered the market. Nevertheless, system manufacturers will feel optimistic due to the frenzied industrialisation and consequent demand for high-quality process water. Further, the depletion of ground-water resources stresses the need for preventive measures.

“An increasing number of industries are operating on the basis of zero liquid discharge with an aim to treat wastewater and reuse it for process water applications and other miscellaneous activities,” said Frost & Sullivan Energy & Environmental Research Analyst Vandhana Ravi.

Rapidly expanding wastewater consciousness will widen the market for multimedia filtration, especially as novel variants in the grades of media enter the market. The increasing competition from membrane filtration solutions will raise the profile of media filtration as a key technology and eventually, lead to notable company mergers and acquisitions.

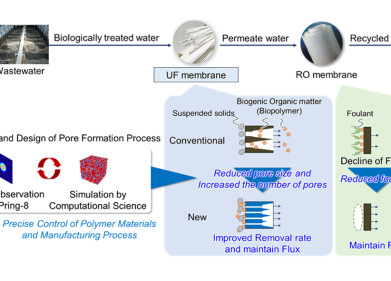

Membrane filtration practices will not act as an entirely disruptive technology, but will cause a surge in the demand for media filtration pre-treatment solutions.

“Technological and competitive perspectives are key factors affecting the market attractiveness for media filtration solutions,” noted Ravi. “Mega Trends of water reuse and recycling, and carbon footprint reduction will create attractive market opportunities and stoke future growth.”

Events

Mar 18 2025 Expo Santa Fe, Mexico

Mar 18 2025 Moscow, Russia

Mar 19 2025 Manila, Philippines

Mar 20 2025 Guangzhou, China

Mar 24 2025 National Harbour, MD, USA