Water/Wastewater

Ballast Water Treatment Systems - Revenues to Shoot up to over 3 Billion

Dec 12 2013

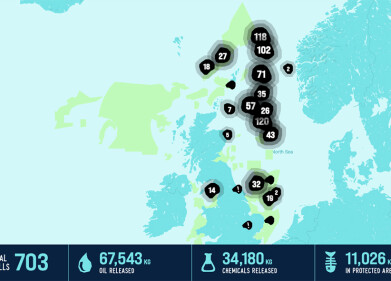

New analysis from Frost & Sullivan (USA) Global Ballast Water Treatment Systems Market, finds that the market earned revenues of $466.6 million in 2013 and estimates this to shoot up to $3.14 billion by 2023, at a compound annual growth rate of 21 percent. The retrofit market is expected to account for a substantial share of the global market during its peak installation period in 2018. Bulk carriers as well as oil and chemical tankers will be key end users, generating cumulative revenues of $17.76 billion and $12.68 billion over the forecast period.

The International Maritime Organization introduced the Ballast Water Management (BWM) Convention in 2004. The convention becomes legally binding 12 months after it has been ratified by 30 states that represent 35 percent in fleet tonnage. Currently, 38 states accounting for 30.38 percent of fleet tonnage, have ratified the convention and should states such as Singapore be the next to ratify the Convention- could get the fleet size target over the 35 percent. However, in the interim the United States Coast Guard (USCG) requirement for vessels using the U.S. waters to be equipped with ballast water treatment systems is set to enter into force from 2014. Since the USCG requires an additional certification to the IMO certification of the ballast water treatment systems, it has provided an interim measure in the form of the Alternate Management System (AMS) approval process which has been secured by about 25 ballast water treatment suppliers so far.

Europe will dominate market revenues from 2017 to 2019, while Asia-Pacific will display consistent performance throughout the study period. Europe shipyard industry also supports major retrofit opportunities, creating a fertile market for BWTS. Asia-Pacific, being a hub for shipbuilding and the base for the majority of ship owners and yards, is a key revenue generating market, particularly in the countries of Japan, China and South Korea.

The research also reveals that North America, though low in terms of ship owners and yards, presents attractive prospects for BWTS manufacturers owing to the sizeable number of suppliers and the implementation of the USCG regulations on ballast water treatment.

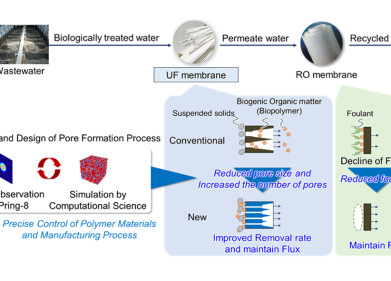

Systems incorporating filtration and UV process appear to dominate the BWTS market at present and the trend is set to continue as newer upgraded versions of these systems are far more energy efficient.

Meanwhile, chemical treatment technologies using electro chlorination, electrolysis and electro chemical treatment have also carved a niche in some of the key vessel segments of the market. Other processes include cavitation, heat, ultrasound, and electro-clean systems.

“Current market leaders will establish a stronghold with upgraded versions of existing ballast water treatment systems, thus preparing themselves for the much anticipated explosive market growth in the coming years,” said Vandhana Ravi, Environment & Building Technologies research analyst at Frost & Sullivan. “While an upsurge of new competitors is unlikely due to the high entry barriers and consolidated nature of the global BWTS market, acquisitions and alliances with key partners will shape the prospects of BWTS suppliers.”

Events

Mar 18 2025 Expo Santa Fe, Mexico

Mar 18 2025 Moscow, Russia

Mar 19 2025 Manila, Philippines

Mar 20 2025 Guangzhou, China

Mar 24 2025 National Harbour, MD, USA