Water/Wastewater

$25B in government funds deliver critical dollars for water infrastructure in 2018

May 08 2019

The federal government's role in rehabilitating water utility infrastructure in the U.S. is taking on even greater importance as municipalities are challenged to keep pace with the aging of more than 70,000 water & wastewater treatment systems and three million miles of underground pipe networks, nationwide.

With overall public spending- local, state, and federal- on water utilities declining year-over-year in five of the last ten years, core federal programs are proving to be more critical in addressing investment needs in urban and rural treatment systems and networks, according to Bluefield Research, a market research firm focused exclusively on water.

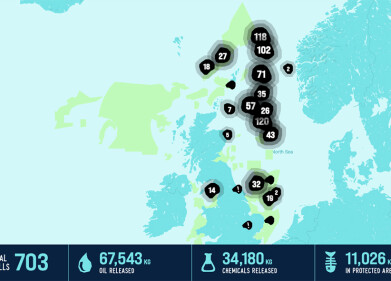

The nation's infrastructure investment needs are evident in Bluefield's ongoing analysis of municipal utility capital improvement plans (CIP) and annual State Revolving Funding (SRF) requests. In 2018, analysis of utility planning documents resulted in as much as $68 billion in capital needs for water & wastewater infrastructure, annually, over the next decade. At the same time, $82 billion was requested from state administered SRF programs for clean (wastewater) and drinking water projects, up from $64 billion in the prior year. With only $15.2 billion awarded though SRF, the gap between utilities' investment needs and available spend is clearly widening.

"SRF loans and grants, which make up 60% of government allocations, are more important than ever as the financial burden falls increasingly on local communities", says Erin Boney Casey, Research Director for Bluefield. "Some states like Ohio are more proactive in supporting requests, while surprisingly, other state funds in Arizona and Tennessee, for example, are underutilized. Navigating these processes can be a challenge and, in fact, technology and equipment vendors are now recognizing the opportunity to support utilities in the application process to make a sale."

Bluefield Research's new report, Funding U.S. Water & Wastewater Infrastructure: Analyzing Government Sources for Project Development, examines $25.3 billion of loans and grants distributed in 2018 through four federal programs: EPA State Revolving Funds (SRF): USDA Loan & Grant Programs, Water Infrastructure Finance and Innovation Act (WIFIA), and U.S. Bureau of Reclamation programs. These funding sources, which address varying geographic needs and project sizes, typically receive bipartisan support and are expected to remain as a water infrastructure mainstays in the absence of a more wide sweeping infrastructure act. In fact, 2018 saw a spike in the amount made available by these programs, with WIFIA expanding to over $4.8 billion in its second year, and the USDA dedicating over $5 billion to its water and waste program in a push to invest in rural communities.

Select cities and states are also becoming more creative and using innovative mechanisms to fund their water infrastructure improvements. Traditionally, rate increases have been a way to pay for improvements, which is not sustainable, particularly with water & wastewater rates increasing by as much as 30% since 2012, outpacing inflation and median household income growth. Because of its own affordability struggles, Philadelphia has moved to implement a new water pricing model to address the 40% of customers falling behind on bill payments at any given time.

Atlanta and Washington D.C. are leveraging environmental impact bonds as an alternative means of financing infrastructure improvements. At the core of this approach, also known as "pay for success", are project-specific performance metrics that can be measured at baseline and monitored thereafter across the life-cycle of the bond.

"There is no one-stop shop for water infrastructure funding. Therefore, utilities and municipalities are being forced to be more creative in finding ways to leverage existing funding sources and financing tools," according to Bonney Casey.

Events

Apr 15 2025 Moscow, Russia

Apr 21 2025 Shanghai, China

May 11 2025 Vienna, Austria

May 18 2025 Algiers, Algeria

23rd International Water Management Exhibition

May 20 2025 Prague, Czech Republic